Blinksai

Add a review FollowOverview

-

Founded Date March 17, 1965

-

Sectors كمبيوتر وشبكات

-

Posted Jobs 0

-

Viewed 27

Company Description

Nvidia Stock May Fall as DeepSeek’s ‘Amazing’ AI Model Disrupts OpenAI

HANGZHOU, CHINA – JANUARY 25, 2025 – The logo of Chinese synthetic intelligence company DeepSeek is … [+] seen in Hangzhou, Zhejiang province, China, January 26, 2025. (Photo credit should read CFOTO/Future Publishing through Getty Images)

America’s policy of limiting Chinese access to Nvidia’s most AI chips has accidentally helped a Chinese AI developer leapfrog U.S. rivals who have full access to the business’s most current chips.

This proves a basic reason why start-ups are typically more effective than big companies: Scarcity generates development.

A case in point is the Chinese AI Model DeepSeek R1 – a complex analytical design taking on OpenAI’s o1 – which “zoomed to the global leading 10 in performance” – yet was built far more quickly, with fewer, less powerful AI chips, at a much lower expense, according to the Wall Street Journal.

The success of R1 should benefit enterprises. That’s since companies see no reason to pay more for an effective AI design when a less expensive one is offered – and is most likely to enhance more rapidly.

“OpenAI’s design is the very best in efficiency, however we likewise do not wish to pay for capabilities we do not need,” Anthony Poo, co-founder of a Silicon Valley-based start-up utilizing generative AI to anticipate monetary returns, told the Journal.

Last September, Poo’s business moved from Anthropic’s Claude to DeepSeek after tests showed DeepSeek “performed likewise for around one-fourth of the expense,” noted the Journal. For example, Open AI charges $20 to $200 per month for its services while DeepSeek makes its platform available at no charge to private users and “charges just $0.14 per million tokens for designers,” reported Newsweek.

Gmail Security Warning For 2.5 Billion Users-AI Hack Confirmed

When my book, Brain Rush, was published last summer season, I was worried that the future of generative AI in the U.S. was too depending on the largest technology business. I contrasted this with the imagination of U.S. start-ups during the dot-com boom – which generated 2,888 initial public offerings (compared to no IPOs for U.S. generative AI start-ups).

DeepSeek’s success might motivate new rivals to U.S.-based big language design developers. If these start-ups build powerful AI designs with less chips and get enhancements to market quicker, Nvidia revenue could grow more slowly as LLM developers duplicate DeepSeek’s method of using less, less sophisticated AI chips.

“We’ll decrease comment,” composed an Nvidia representative in a January 26 email.

DeepSeek’s R1: Excellent Performance, Lower Cost, Shorter Development Time

DeepSeek has actually impressed a leading U.S. endeavor capitalist. “Deepseek R1 is among the most amazing and impressive advancements I have actually ever seen,” Silicon Valley endeavor capitalist Marc Andreessen composed in a January 24 post on X.

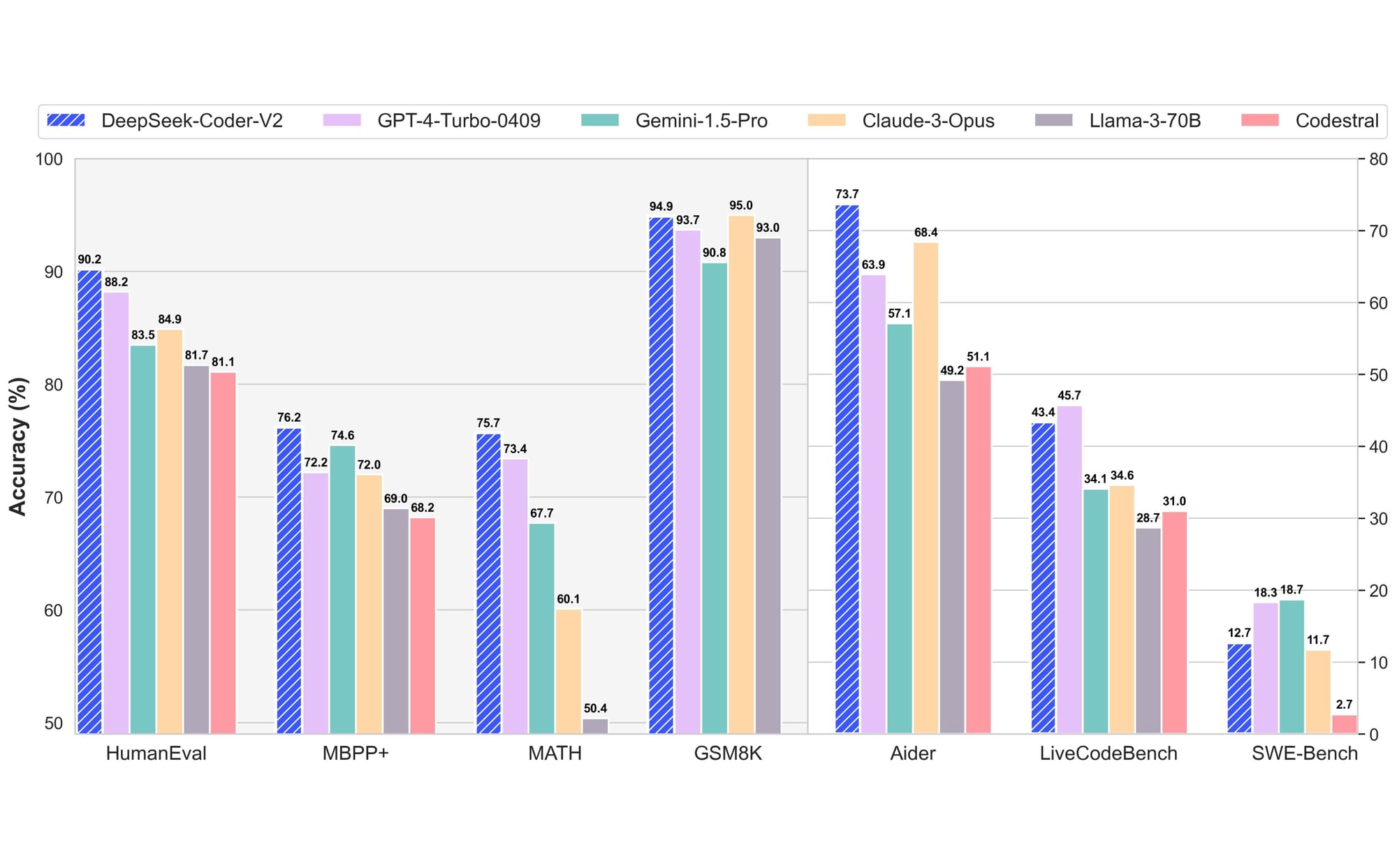

To be reasonable, DeepSeek’s technology lags that of U.S. rivals such as OpenAI and Google. However, the business’s R1 model – which released January 20 – “is a close competing in spite of utilizing fewer and less-advanced chips, and in some cases avoiding actions that U.S. developers considered important,” kept in mind the Journal.

Due to the high cost to release generative AI, business are increasingly questioning whether it is possible to make a positive roi. As I wrote last April, more than $1 trillion could be invested in the technology and a killer app for the AI chatbots has yet to emerge.

Therefore, companies are excited about the prospects of lowering the investment required. Since R1’s open source design works so well and is so much less costly than ones from OpenAI and Google, business are keenly interested.

How so? R1 is the top-trending design being downloaded on HuggingFace – 109,000, according to VentureBeat, and matches “OpenAI’s o1 at simply 3%-5% of the cost.” R1 also supplies a search feature users evaluate to be remarkable to OpenAI and Perplexity “and is just matched by Google’s Gemini Deep Research,” kept in mind VentureBeat.

DeepSeek established R1 more rapidly and at a much lower expense. DeepSeek stated it trained among its most current models for $5.6 million in about 2 months, noted CNBC – far less than the $100 million to $1 billion variety Anthropic CEO Dario Amodei mentioned in 2024 as the expense to train its models, the Journal reported.

To train its V3 model, DeepSeek utilized a cluster of more than 2,000 Nvidia chips “compared with 10s of thousands of chips for training models of similar size,” kept in mind the Journal.

Independent analysts from Chatbot Arena, a platform hosted by UC Berkeley scientists, ranked V3 and R1 models in the leading 10 for chatbot performance on January 25, the Journal wrote.

The CEO behind DeepSeek is Liang Wenfeng, who manages an $8 billion hedge fund. His hedge fund, named High-Flyer, used AI chips to build algorithms to determine “patterns that might affect stock prices,” kept in mind the Financial Times.

Liang’s outsider status helped him be successful. In 2023, he introduced DeepSeek to establish human-level AI. “Liang constructed a remarkable infrastructure team that actually comprehends how the chips worked,” one creator at a rival LLM company informed the Financial Times. “He took his finest people with him from the hedge fund to DeepSeek.”

DeepSeek benefited when Washington banned Nvidia from exporting H100s – Nvidia’s most powerful chips – to China. That forced local AI business to engineer around the deficiency of the limited computing power of less powerful regional chips – Nvidia H800s, according to CNBC.

The H800 chips transfer information in between chips at half the H100’s 600-gigabits-per-second rate and are generally less costly, according to a Medium post by Nscale primary business officer Karl Havard. Liang’s team “currently knew how to fix this issue,” kept in mind the Financial Times.

To be fair, DeepSeek stated it had actually stockpiled 10,000 H100 chips prior to October 2022 when the U.S. enforced export controls on them, Liang informed Newsweek. It is uncertain whether DeepSeek used these H100 chips to develop its models.

Microsoft is very pleased with DeepSeek’s accomplishments. “To see the DeepSeek’s brand-new model, it’s incredibly remarkable in terms of both how they have actually actually effectively done an open-source design that does this inference-time calculate, and is super-compute effective,” CEO Satya Nadella said January 22 at the World Economic Forum, according to a CNBC report. “We should take the developments out of China really, very seriously.”

Will DeepSeek’s Breakthrough Slow The Growth In Demand For Nvidia Chips?

DeepSeek’s success need to stimulate modifications to U.S. AI policy while making Nvidia financiers more cautious.

U.S. export constraints to Nvidia put pressure on start-ups like DeepSeek to focus on effectiveness, resource-pooling, and cooperation. To develop R1, DeepSeek re-engineered its training process to utilize Nvidia H800s’ lower processing speed, former DeepSeek worker and current Northwestern University computer technology Ph.D. student Zihan Wang told MIT Technology Review.

One Nvidia scientist was enthusiastic about DeepSeek’s accomplishments. DeepSeek’s paper reporting the outcomes brought back memories of pioneering AI programs that mastered board video games such as chess which were built “from scratch, without imitating human grandmasters initially,” senior Nvidia research study scientist Jim Fan said on X as included by the Journal.

Will DeepSeek’s success throttle Nvidia’s growth rate? I do not know. However, based upon my research study, businesses clearly desire powerful generative AI models that return their investment. Enterprises will be able to do more experiments intended at discovering high-payoff generative AI applications, if the expense and time to construct those applications is lower.

That’s why R1’s lower cost and much shorter time to perform well must continue to bring in more business interest. An essential to delivering what services desire is DeepSeek’s ability at enhancing less effective GPUs.

If more start-ups can duplicate what DeepSeek has actually accomplished, there might be less demand for Nvidia’s most expensive chips.

I do not know how Nvidia will respond should this take place. However, in the short run that might imply less earnings development as start-ups – following DeepSeek’s method – build designs with less, lower-priced chips.